Vercel statistics reveal explosive growth with the frontend development platform achieving a staggering $200 million annual revenue in 2025 and fielding acquisition offers valuing the company between $8-9 billion. The San Francisco-based startup has raised $563 million across five funding rounds, establishing itself as the dominant force in modern web development infrastructure.

These impressive numbers reflect Vercel’s transformation from a developer tool into an essential platform powering millions of websites, with over one million developers using its Next.js framework monthly and enterprise clients generating billions in sales on the platform.

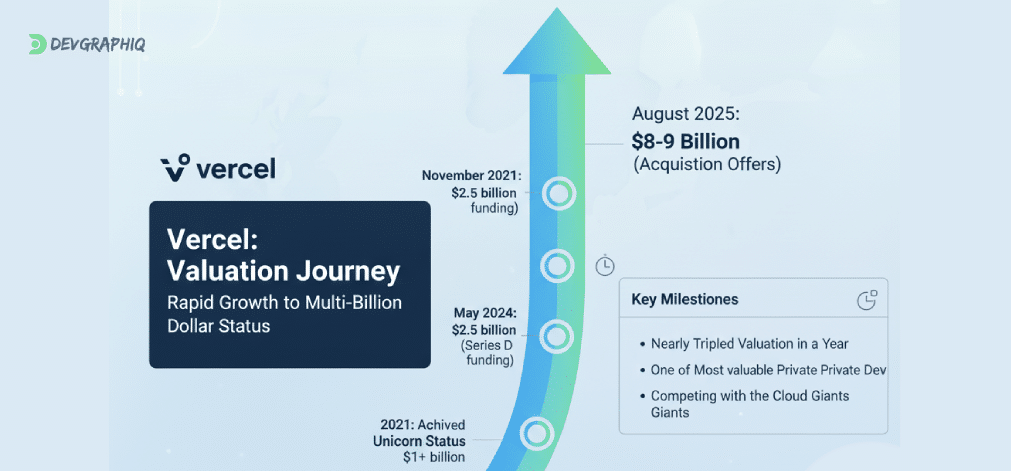

Vercel Valuation: From Startup to $9 Billion Powerhouse

Current Valuation and Market Position

Vercel’s valuation journey demonstrates remarkable growth trajectory in the competitive developer tools market. As of August 2025, Vercel is fielding offers valuing the company between $8 billion and $9 billion, representing nearly triple growth from their Series E valuation just over a year prior.

This dramatic valuation increase positions Vercel among the most valuable private development platform companies globally, competing directly with established cloud infrastructure giants while maintaining focus on frontend development excellence.

Valuation timeline progression:

- August 2025: $8-9 billion (acquisition offers)

- May 2024: $3.25 billion (Series E funding)

- November 2021: $2.5 billion (Series D funding)

- 2021: Achieved unicorn status ($1+ billion)

- 2019: Early-stage startup valuation

Factors Driving Valuation Growth

The AI development boom significantly impacts Vercel’s valuation surge, with enterprise clients like OpenAI, Under Armour, and Perplexity driving substantial platform adoption. Vercel’s customer base spans from individual developers to major enterprises including OpenAI, Under Armour, and Perplexity, demonstrating broad market appeal across company sizes.

Key valuation drivers:

- AI application development surge

- Enterprise client expansion

- Next.js framework dominance

- Revenue growth acceleration

- Market leadership in frontend deployment

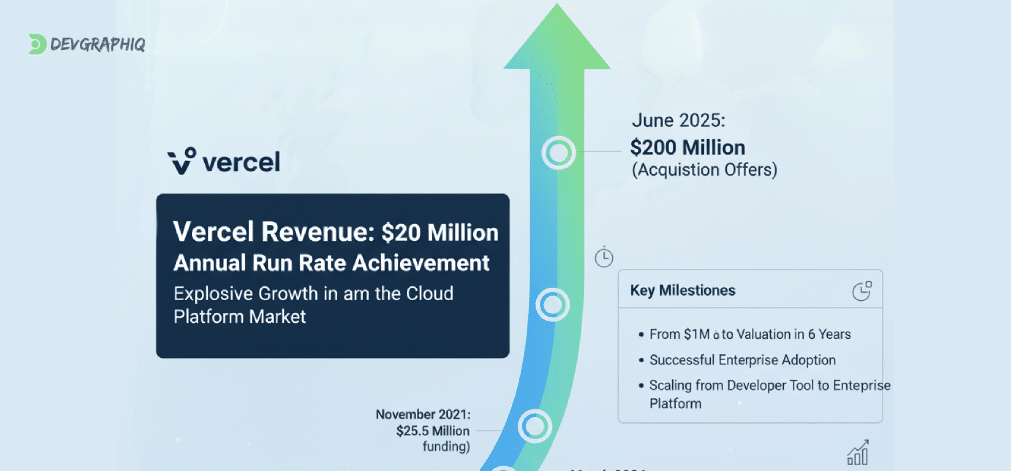

Vercel Revenue: $200 Million Annual Run Rate Achievement

Revenue Growth Trajectory

Vercel achieved remarkable revenue growth, hitting $200M in revenue in June 2025, demonstrating exceptional scaling capabilities in the competitive cloud platform market. This represents substantial growth from previous milestones, with the company maintaining consistent upward momentum.

Revenue milestone progression:

- June 2025: $200 million annual revenue

- March 2024: $100 million annual revenue

- November 2021: $25.5 million annual revenue

- 2019: $1 million revenue baseline

The company’s revenue progression from $1M in 2019 to $172M in Q2 2025 demonstrates successful enterprise adoption, highlighting Vercel’s ability to scale from developer tool to enterprise platform effectively.

Revenue Per Employee Efficiency

With a team of 752 people generating $200 million annually, Vercel achieves approximately $266,000 in revenue per employee, indicating exceptional operational efficiency compared to traditional enterprise software companies.

Operational metrics:

- Total team size: 752 employees (2025)

- Revenue per employee: $266,000 annually

- Growth efficiency: Maintained lean operations during scaling

- Team distribution: Global remote-first organization

AI Product Revenue Contribution

As of February 2025, v0 was estimated to generate $42M ARR (~21% of total revenue) since launching just over a year prior, demonstrating Vercel’s successful expansion into AI-powered development tools. This rapid adoption of v0 showcases the company’s ability to innovate and monetize emerging technology trends.

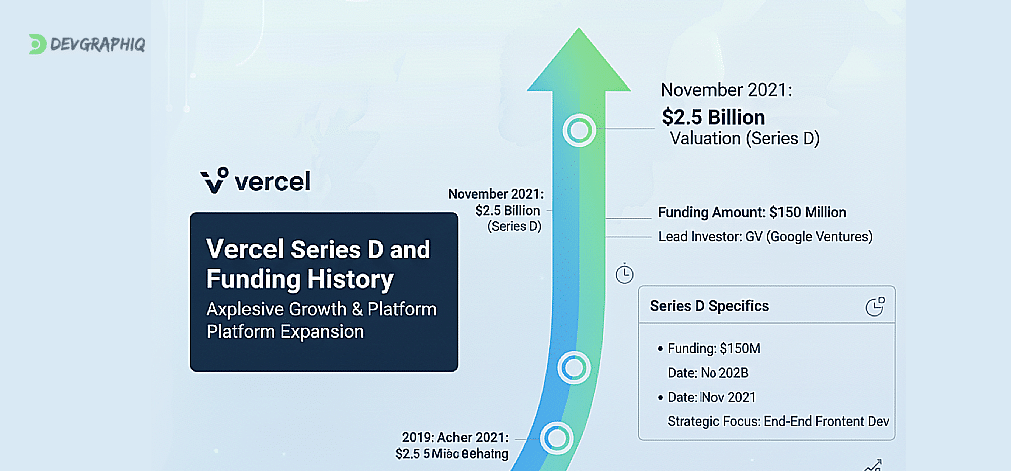

Vercel Series D and Funding History

Series D Funding Round Details

Vercel raised $150M Series D at a $2.5B valuation in November 2021, marking a significant milestone in the company’s funding journey. This Series D round positioned Vercel for accelerated growth and platform expansion initiatives.

Series D funding specifics:

- Funding amount: $150 million

- Valuation achieved: $2.5 billion

- Date completed: November 2021

- Lead investor: GV (Google Ventures)

- Strategic focus: End-to-end frontend development platform

Series E Funding and Recent Capital Raise

Vercel has a valuation of $3.25 billion as of May 2024, following its Series E funding round of $250 million. The round was led by Accel, with participation from existing investors CRV, GV, Notable Capital, Bedrock, Geodesic Capital, Tiger Global, 8VC and SV Angel.

Series E funding breakdown:

- Funding amount: $250 million

- Valuation: $3.25 billion

- Lead investor: Accel

- Completion date: May 2024

- Strategic purpose: AI product development and market expansion

Total Funding Raised

Vercel raised a total funding of $563M over 5 rounds from 23 investors, representing substantial investor confidence in the company’s market position and growth potential. This comprehensive funding enables continued platform development and competitive positioning.

Complete funding summary:

- Total raised: $563 million

- Number of rounds: 5 major funding rounds

- Investor count: 23 participating investors

- Funding timeline: 2019-2024 active fundraising period

Vercel Investors: Strategic Backing and Partnership

Lead Investor Participation

Vercel attracts top-tier venture capital firms and strategic investors, demonstrating strong institutional confidence in the company’s market opportunity and execution capabilities.

Major investor participants:

- Accel: Series E lead investor

- GV (Google Ventures): Series D lead and continued participation

- CRV: Multi-round investor

- Notable Capital: Strategic participant

- Tiger Global: Growth-stage investor

- 8VC: Technology-focused fund

- SV Angel: Early-stage supporter

Strategic Investor Value

Beyond financial investment, Vercel’s investor base provides strategic value through:

- Technical expertise from Google Ventures

- Enterprise connections through Accel’s portfolio

- Growth strategy guidance from Tiger Global

- Developer community insights from strategic partners

Angels of Many, Base Case Capital, Goanna Capital, Ground Control Ventures, and Inflection Ventures (New York) are 5 of 45 investors who have invested in Vercel, indicating broad investor interest across different investment stages and geographies.

Developer Adoption and Platform Statistics

Next.js Framework Dominance

More than one million developers using its Next.js open-source framework technology monthly, establishing Vercel’s Next.js as the leading React-based framework for modern web development. This massive developer adoption creates strong platform stickiness and organic growth drivers.

Developer engagement metrics:

- Monthly active developers: 1+ million using Next.js

- Framework market share: Leading React-based solution

- Community contributions: Active open-source ecosystem

- Enterprise adoption: Major companies standardizing on Next.js

Platform Usage Growth

Vercel’s platform handles significant deployment volume and traffic, supporting applications ranging from personal projects to enterprise-scale systems serving millions of users globally.

Platform performance indicators:

- Applications deployed: Millions across platform

- Traffic handled: Massive global scale

- Uptime performance: Enterprise-grade reliability

- Geographic coverage: Worldwide edge network

Enterprise Client Success Stories

Enterprise clients achieve substantial business impact through Vercel implementation. Despite a challenging retail environment, it continues to excel in ecommerce, showcasing a 3% growth in direct-to-consumer revenue to 2.3 billion, with one retailer seeing significant sales increases after migrating to Vercel.

Enterprise value propositions:

- Performance improvements: Faster loading times

- Conversion optimization: Enhanced user experiences

- Developer productivity: Streamlined deployment workflows

- Global scale: Edge network performance benefits

Market Position and Competitive Landscape

Revenue Leadership in Deployment Platforms

In comparison to direct competitors in the serverless deployment space, Vercel leads with $100 million in revenue, ahead of Netlify at $75 million, demonstrating clear market leadership in the frontend deployment category.

Competitive positioning:

- Vercel: $200M revenue (2025 current)

- Netlify: $75M revenue (primary competitor)

- Market share leadership: Dominant position in frontend deployment

- Technology differentiation: Next.js ecosystem advantages

Broader Cloud Platform Competition

While leading in frontend deployment, Vercel competes with broader cloud platforms including AWS Amplify, Cloudflare Pages, Render, and Heroku. The company maintains differentiation through developer experience focus and Next.js integration.

Competitive advantages:

- Developer experience optimization

- Next.js framework integration

- AI-powered development tools

- Enterprise-grade performance and security

AI Strategy and Future Growth Drivers

v0 AI Development Tool Success

Vercel’s AI strategy centers around v0, an AI-powered UI generation tool that quickly gained significant traction. The product generates approximately 21% of total company revenue within just over one year of launch, demonstrating strong product-market fit in AI-assisted development.

v0 performance metrics:

- Annual revenue: $42M ARR (February 2025)

- Revenue percentage: ~21% of total company revenue

- Launch timeline: Achieved scale within one year

- Market reception: Strong developer adoption

AI Development Market Opportunity

By integrating with enterprise workflows and adding security features, Vercel can capture more of the $450 billion enterprise application development market, positioning the company for substantial growth in AI-powered development tools.

Market expansion opportunities:

- Enterprise AI application development

- Automated code generation tools

- AI-powered deployment optimization

- Developer productivity enhancement

Enterprise Market Penetration

Enterprise ROI and Value Delivery

Vercel elevates your Enterprise, delivering over 250% ROI by accelerating time to market and increasing on-page customer conversion rates, demonstrating clear value proposition for enterprise clients considering platform adoption.

Enterprise benefits:

- ROI achievement: 250%+ return on investment

- Time to market: Accelerated development cycles

- Conversion optimization: Improved user experiences

- Development efficiency: Streamlined workflows

Enterprise Client Portfolio

Major enterprise clients including OpenAI, Under Armour, and Perplexity showcase Vercel’s ability to serve high-scale, mission-critical applications across diverse industries.

Enterprise client categories:

- AI companies: OpenAI and similar platforms

- E-commerce retailers: Global brands and marketplaces

- Technology platforms: Developer tools and services

- Content platforms: Media and publishing companies

Financial Performance and Growth Metrics

Revenue Growth Rate Analysis

Vercel demonstrates exceptional revenue growth rates, doubling revenue from $100M to $200M in approximately 15 months. This acceleration indicates strong market demand and successful execution of growth strategies.

Growth rate indicators:

- 2024-2025: 100% revenue growth (15 months)

- Historical CAGR: Triple-digit growth rates

- Market expansion: Enterprise segment penetration

- Product diversification: AI tools contributing significant revenue

Path to Profitability

With $200M annual revenue and a 752-person team, Vercel approaches sustainable unit economics while maintaining growth investments. The company balances growth spending with operational efficiency as it scales toward potential profitability.

Financial health indicators:

- Revenue scale: $200M annual run rate

- Team efficiency: High revenue per employee

- Investment balance: Growth vs. efficiency optimization

- Market position: Leading platform in category

IPO Readiness and Exit Opportunities

Public Market Preparation

Vercel is “buzzing with excitement,” and for good reason—it’s redefining how the web is built, one deployment at a time, with industry speculation around potential IPO timing as the company reaches public market scale and readiness.

IPO readiness factors:

- Revenue scale: $200M+ annual revenue

- Market leadership: Dominant position in category

- Enterprise client base: Diverse, high-value customers

- Financial metrics: Strong unit economics and growth rates

Acquisition Interest and Strategic Options

The $8-9 billion acquisition offers Vercel reportedly receives demonstrate significant strategic interest from major technology companies seeking to enhance their developer platform capabilities.

Strategic value drivers:

- Developer ecosystem: Next.js community and adoption

- AI capabilities: v0 and development automation tools

- Enterprise relationships: High-value client portfolio

- Technical differentiation: Performance and developer experience advantages

Conclusion: Vercel’s Remarkable Growth Trajectory

Vercel statistics demonstrate exceptional performance across key growth metrics, with $200 million annual revenue, $8-9 billion valuation offers, and $563 million total funding establishing the company as a dominant force in modern web development infrastructure. The platform serves over one million developers monthly while generating substantial enterprise value through performance optimization and developer productivity improvements.

The company’s successful expansion from developer tool to comprehensive frontend platform, combined with AI innovation through v0 and strategic enterprise client relationships, positions Vercel for continued growth in the rapidly expanding web development market. With strong investor backing, proven revenue scalability, and market-leading technology differentiation, Vercel represents one of the most successful developer-focused platforms of the past decade.

For developers, investors, and technology leaders tracking modern web development trends, Vercel’s growth trajectory illustrates the massive market opportunity in developer experience optimization and AI-powered development tools. The company’s financial performance and market position suggest continued leadership in frontend development infrastructure as web applications become increasingly sophisticated and performance-critical.